Source: Real Estate Council of Alberta

Currently, Alberta’s real estate market is extremely competitive, with limited supply of homes for sale, meaning sellers often receive multiple offers. Home buyers may feel they need to tailor their offer to appeal to the home seller and may consider making a condition-free offer to stand out from other buyers. RECA is advising consumers that this home buying strategy has risks.

Most offers to purchase a home are conditional, meaning they have criteria that must be met before the property purchase can be completed. These criteria must be written into the offer to purchase, with an exact explanation of how the condition will be met, and the timeframe for when the condition must be met. If the buyer does not waive conditions by the agreed upon deadline, an offer to purchase becomes void.

A condition can be anything the buyer and seller agree to, as long as it is written in the signed offer to purchase. Typical conditions include conditions for a buyer to:

- secure financing

- complete a home inspection to their satisfaction

- review condominium documents to their satisfaction

- finalize the sale of their current property

Conditional offers allow buyers and their licensees to perform due diligence research on a property, such as getting a home inspection and properly reviewing all relevant information such as the title or condominium documents. Conditional offers also allow buyers to secure financing for the property, typically through a mortgage.

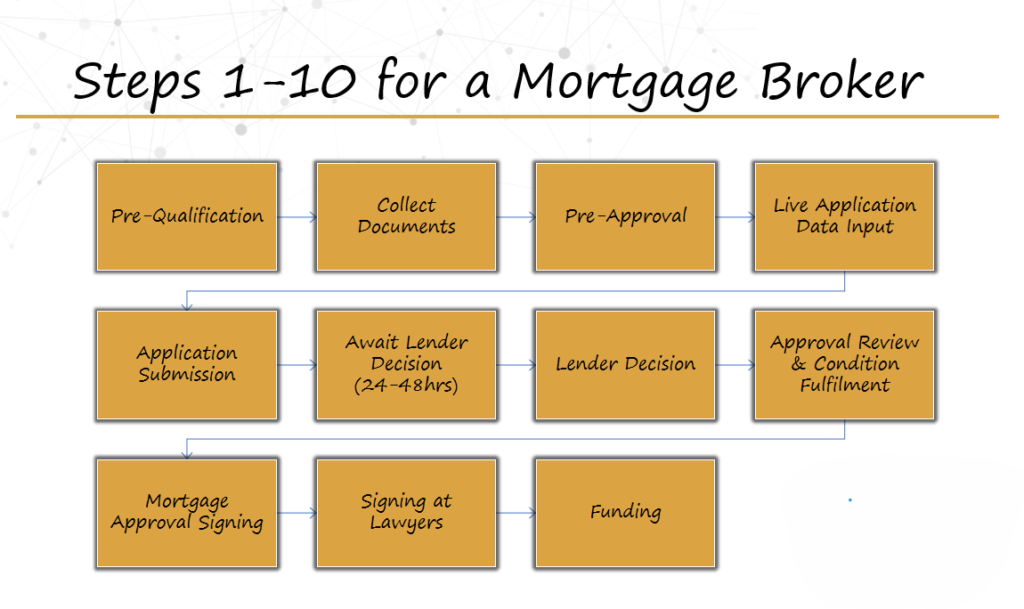

Consumers should be aware the difference between Pre-qualification and Pre-approval. Pre-qualification is a quick calculation comparing income to debts to estimate a borrowers affordability. Pre-approval is an extensive look into the borrower`s profile. This includes collecting and reviewing income and down payment documents, checking credit and in some cases comes with a rate hold. However, a mortgage pre-approval is not a guarantee they will obtain financing. Mortgage pre-approval is only tentative approval based on the buyer’s basic financial information. It is also important to note that at the pre-approval stage, the property is not yet known. Property type, location, or value can impact the financing available.

For any reason, including not securing financing, if a home buyer fails to complete the purchase as stated, they may forfeit their deposit and could face legal action by the seller.

Consumers are urged to discuss any plans to make a condition-free offer with their real estate licensee. Home buyers should also be sure to speak to their mortgage broker about the financing implications of submitting a condition-free offer.